The universe loves its cycles and hates the extremes. From forest relations like foxes and rabbits to human relations like equally sharing wealth, nature always balances systems where two species interact—one as predator, the other as prey. In science, this is known as Lotca-Volterra equations. It explains how uber-rich, financial predators like Zuckerberg, Bezos & Musk opportunistically prey on the diminishing, hard-earned money of our getting-poorer, working middle class and why this will inevitably turn around.

The universe loves its cycles and hates the extremes. From forest relations like foxes and rabbits to human relations like equally sharing wealth, nature always balances systems where two species interact—one as predator, the other as prey. In science, this is known as Lotca-Volterra equations. It explains how uber-rich, financial predators like Zuckerberg, Bezos & Musk opportunistically prey on the diminishing, hard-earned money of our getting-poorer, working middle class and why this will inevitably turn around.

There’s always been a cycle of wealth disparity. It’s part of nature’s apparent plan. The rich get richer, and the poor get poorer. Then the pendulum swings and tries to restore equilibrium or some balance. Just as the fox and rabbit populations cycle in nature.

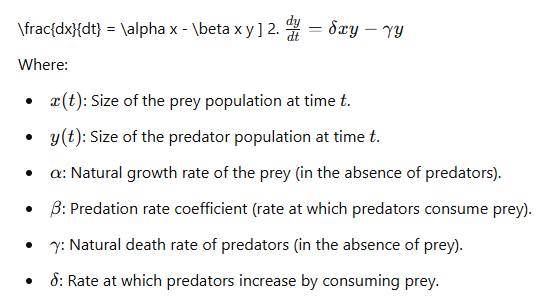

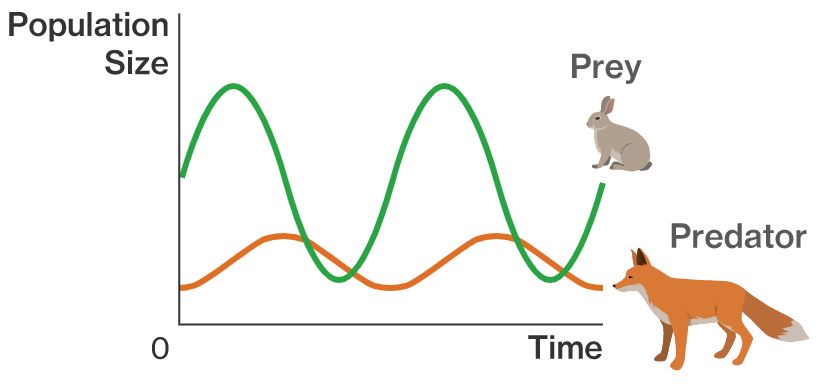

Alfred Lotca and Vito Volterra were two biologists. Circa 1925, they developed a mathematical formula after observing predator-prey relations in American fox and rabbit interactions. The LV equations describe the dynamics of biological systems in which two species interact as predator and prey. These equations form a foundational part of modern ecological and mathematical biology.

They’re also equally applicable to finance and economics—accounting for the billionaires who are now owning the world.

The Lotka-Volterra formula is a pair of first-order, nonlinear differential equations used to describe the dynamics of two interacting species—a predator population and a prey population. These equations model how the two populations affect each other’s growth over time. The Lotka-Volterra predator-prey model is expressed as:

For people like me who suck at math, this means when the foxes are low, the rabbits will grow, then so will the foxes who eat all the rabbits, and when the rabbit-food disappears, the foxes drop off so the rabbits can do what rabbits do do and the cycle repeats in a loop. Typically, it’s a seven-to-nine-year pattern.

The same occurs in our human financial world but in a much longer frame. Money tends to ebb and flow, then flow and ebb. It transfers as the lifeblood in our economic system, and it keeps us alive as a country and as a civilization. However, just like the predatory foxes take advantage of the population-producing rabbits, people at the top of the financial food chain feast upon those who feed it. At some point it shifts.

Predation works for many apexers. Sharks. Orcas. Polar Bears. Lions. Honey Badgers. Humans too, including many multi-billionaires like the names I mentioned—Zuckerberg, Bezos & Musk.

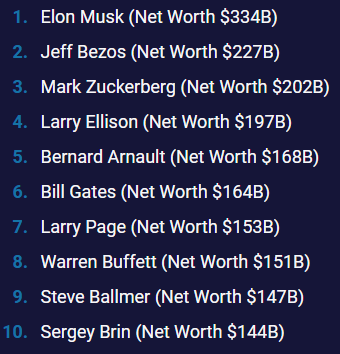

These three guys are phenomenally wealthy, as in f’n stinkin’ r-r-rich. But they’re not alone. Here’s a table of the ten top money holders in America, and note they’re all male, white, and clean-shaven. Plus, most of them are toilets in their personal lives with scads of paper hoarded in their closets.

The gap between the have-nots and have-yachts is enormous. A recent Rand study shows the currency cycle has spread to where the top one percent of Americans have taken fifty trillion dollars from the bottom ninety percent in the past two decades. That’s 1% = $50,000,000,000,000, or 50 x 10 to the 12th. A mind-staggering and colossal figure.

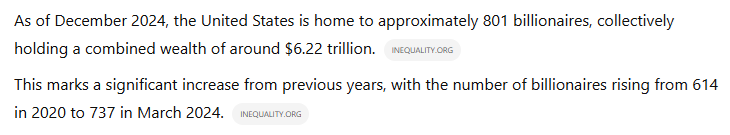

Doing a little fact-checking, here are figures on the recent growth of billionaires in the USA.

So, who are these titans? These elite, moguls, oligarchs, and aristocratic tycoons? Doing a little psych-snooping, these seem to be the billionaire traits:

- Highly ambitious and driven

- Resilient and risk-takers

- Innovative thinkers

- Strong work ethics

- Focussed and disciplined

- Curious and observant

- Lifelong learners

- Charismatic and natural leaders

- Emotionally intelligent

- Problem solvers

- Desire for impact

- Autonomous

- Competitive

- Acutely aware of success

- Pursuit of excellent

- Often turn into philanthropists

- Or just greed

Becoming a billionaire isn’t easy. To a tee, they work extremely hard and thoroughly understand the fundamental, core concepts of compounding and entropy along with time and change. These are the four pillars of rich. Here are key reasons they become so wealthy:

- Exponential growth through compound investments

- Offsetting entropy

- Working money markets of derivatives, hedges, and currency trading

- Ownership of high-growth businesses

- Timing and market trends

- Global scaling

- Leveraging time, capital, and technology

- High risk and high reward

- Long-term vision and persistence

- Strategic networking

- Systemic advantage

- Being acutely aware of change

- Or just greed

This new-money breed understands the nature of cycles. They’ve studied the history of names who’ve gone before. Carnegie, Vanderbilt, Morgan, Ford, Rockefeller, Gould, Field, and Walton. And they know the periods of American economic ebb and flow:

- Late 1700s agricultural economy

- Early 1800s industrial revolution

- Early 1900s wealth redistribution and stabilization

- 1920s-1930s economic boom and bust

- 1930s great depression

- 1940s war and recovery

- 1945-1970 post-war boom

- 1980s-2000s neoliberal return to wealth concentration

- 2008-2020s financial crisis and severe inequality

- 2025 and on – who knows

No one knows the future. We can only understand the past, live in the present, and somewhat prepare for the future. The escalating state of supreme wealth concentration and extreme capital division in America is unsustainable. Something will snap and start a new cycle of return to middle ground—a Black Swan event no one sees coming and delivers a catastrophic financial blow that redistributes wealth.

One person who’s analyzed the situation we’re in is Thom Hartmann. In his Hartmann Report article titled What the Science of Predators and Prey Tells Us About the Morbidly Rick and Working People, Mr. Hartmann gives a candid personal opinion of the imbalance which I’d be hard-pressed to do better. Regardless of his political slant that I try to stay neutral on, this piece is well worth the read. With full attribution to Thom Hartmann and no gain to this website or me as a writer, here’s the full, unedited content.

Nature and economics share some fascinating patterns, one of which explains why Donald Trump is about to become president and how the morbidly rich have appropriated over $50 trillion from working-class people since the 1980s. Scientists use something called the Lotka-Volterra equations to explain how predators and prey interact in the wild.

These equations show us that animal populations rise and fall in predictable cycles — when there are lots of rabbits, fox populations grow, but as foxes eat more rabbits, the rabbit population shrinks, which then causes fox numbers to drop, allowing rabbits to multiply again.

Incredibly, this back-and-forth pattern mirrors what happens between the wealthy and working classes in our economy and political systems over the past 100 years.

Think about a forest ecosystem. When rabbits have plenty of grass to eat and safe places to hide, their numbers grow. As rabbit populations increase, foxes find it easier to catch prey, so they have more cubs and their numbers grow, too.

But eventually, the foxes become so numerous that they start catching too many rabbits. The rabbit population crashes, and soon after, fox numbers follow suit because there isn’t enough food to go around. This creates a natural cycle that repeats over and over, unless something comes along to change the rules of the game — like a new predator, a disease, or human intervention.

This same pattern plays out in our economy and political system, though we often don’t recognize it.

The working class, like the rabbits, create value through their labor and create demand — which drives economies — through their purchases of goods and services. They make products, provide services, consume both, and thus keep the economy running.

The wealthy class, like the foxes, extracts value through ownership, investment, and control of resources. When the system is balanced, both groups can thrive. But when it gets out of balance, trouble follows.

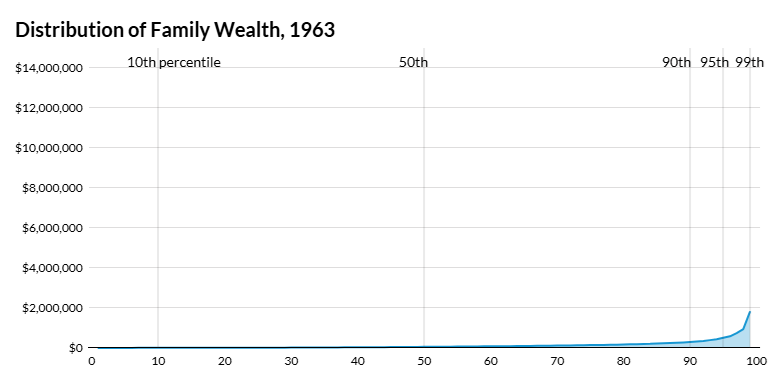

To see this pattern in action, look at a remarkable period in American history called the “Great Compression.” From 1900 to 1980 (with the brief exception of the Roaring Twenties), particularly after the New Deal, something unusual happened: the gap between rich and poor actually shrank for roughly 80 years. Working people saw their wages go up and their living standards improve.

This happened because new rules and institutions — including labor unions, Wall Street regulations, anti-monopoly laws, and higher progressive income taxes — kept economic “predators” (morbidly rich individuals and corporations) from taking too much from economic “prey” (working class and poor people).

Just like a healthy forest needs the rules of nature as expressed in the Lotka-Volterra equations to keep any one species from taking over, these progressive policies put into place by FDR created balance in the economy, and thus political harmony across the nation.

The specifics of those rules were comprehensive and carefully designed. The highest income tax rate on the wealthiest Americans was 90% in that era. Labor unions were protected by law and represented about one-third of all workers, meaning two-thirds of workers had the wage and benefits equivalent of a union job (union employers set local wage and benefit floors). Banks were strictly regulated and couldn’t engage in risky speculation with ordinary people’s savings.

Monopolies were broken up when they became too powerful; the Supreme Court blocked the merger of two shoe companies in the 1960s because the new combined company would control 5% of the shoe industry (today Nike has 19%).

Those rules didn’t prevent people from getting rich, but they did ensure that extreme wealth accumulation was harder and that workers received a fair share of the value they created.

The results were impressive. Between 1945 and 1980, when workers produced more, they earned more. A single breadwinner could support a family, own a home, buy a new car every few years, take a vacation, send kids to college, and retire with dignity and a pension.

Social mobility was high, meaning children regularly achieved higher living standards than their parents. The wealth created by the economy was shared more fairly than ever before.

The rich still got richer, but at a slower, more sustainable pace that allowed everyone else to prosper too.

This balance didn’t last. In 1971, future (1972) Supreme Court Justice Lewis Powell wrote a memo that changed everything. He urged American businesses to fight against unions, environmental protections, and other rules that limited their power, crush the labor movement, and put corporations and rich people in charge of the commons.

This memo wasn’t just idle speculation; it became a blueprint for action. Business leaders and fossil-fuel billionaires created new think tanks, funded academic programs promoting so-called free-market ideology, and invested heavily in lobbying and political campaigns.

When Ronald Reagan became president in 1981, he started dismantling the rules that had kept the morbidly rich economic predators and their companies in check. He turned loose the foxes on the rabbits.

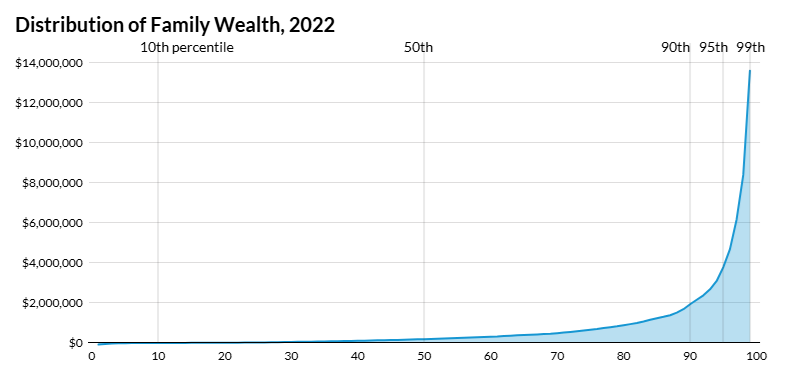

This era, which we might call the “Great Predation,” saw a dramatic reversal of the trends that defined the Great Compression. From 1980 to 2024, the wealthiest Americans extracted over $50 trillion from the working class, according to studies such as the Rand Corporation’s 2020 report on income redistribution.

Productivity continued to rise, but wages stagnated, and wealth increasingly concentrated at the top. The predators were thriving, but the prey — working-class Americans — were being systematically drained.

Reagan dramatically cut taxes on the morbidly rich. He, Bush, and Trump stripped away business regulations and Republicans on the Supreme Court stopped enforcing antitrust law. Unions lost their power when companies — with the support of Republicans on the Court — were allowed to fight them more aggressively.

Even Social Security and Medicare faced pressure, though they largely survived (although Republicans have already half-privatized Medicare with the Medicare Advantage scam and are now talking about doing the same with Social Security).

While workers kept producing more, their wages barely grew. Instead, nearly all the new wealth went to those at the top. The predators were thriving, but their prey — ordinary working Americans — were being squeezed dry.

The changes were dramatic and far-reaching. CEO pay skyrocketed from about 30 times the average worker’s salary in 1980 to over 300 times by 2020. In some industries it’s thousands of times more, and in the companies of some billionaires like Musk, Zuckerberg, and Bezos, their income is hundreds of thousands or millions of times greater than their workers.

As a result of five corrupt Republicans on the Supreme Court giving the morbidly rich the absolute power to own politicians and put unlimited money into elections, the predation of the morbidly rich has gone into hyperdrive. The most obvious example of this recently was Elon Musk purchasing the White House for Trump with a bit more than a quarter-billion dollars, an amount that was basically pocket change for him.

More than half of Americans now live paycheck to paycheck, despite the country being richer than ever. Young people struggle to afford homes, start families, or save for retirement. Medical debt has become a leading cause of bankruptcy. Meanwhile, both the number of billionaires and their aggregate wealth have exploded, with some individuals accumulating more wealth than entire countries.

This pattern follows the same logic as those predator-prey equations. During the Great Compression, government rules acted like environmental protections, helping the middle class grow strong and creating a healthy consumer economy.

The wealthy still benefited but couldn’t take too much. During the Great Predation, those protections disappeared. Without limits on economic predators, working people’s share of the pie began to shrink, just like rabbit populations fall when foxes have free rein.

But here’s the catch: just as foxes eventually run into trouble if they eat too many rabbits, extreme concentration of wealth creates problems for the wealthy too. When middle-class consumers struggle, the whole economy becomes unstable.

We see this today in several ways: young people can’t afford to buy homes or cars, leading to weak demand in key industries. Consumer debt has reached record levels as people try to maintain their standard of living. Social and political unrest grows as people lose faith in the system. We might be approaching a breaking point, and the 2024 election is a major warning.

The signs of strain are everywhere. Major retailers struggle as their customer base loses purchasing power. Tech companies lay off thousands despite record profits, trying to squeeze more value from fewer workers.

Young people increasingly reject capitalism altogether, correctly seeing Reagan’s version of it as a rigged game. Political polarization has reached dangerous levels as people search for someone to blame, resulting in the rise of demagogues like Trump, Vance, and Musk. And the steady stream of oligarchs rushing to Mar-a-Lago to kiss Trump’s ass.

The good news is that we can learn from nature about how to restore balance. In healthy ecosystems, predators and prey find a sustainable balance through natural mechanisms and occasional external interventions. In our economy, we know we can create this balance through smart policies because we already did it once for almost 80 years.

We need modern versions of the rules that worked during the Great Compression: Fair taxes, strong worker protections, and limits on corporate power. We also need new ideas, like universal basic income or profit-sharing, that can help distribute wealth more evenly.

Some specific solutions are already being tested around the world.

Worker representation on corporate boards, common in Germany, helps ensure companies consider employee interests. Public investment banks, like those in South Korea and Japan, can direct capital toward social needs rather than just private profits. Alaska’s Permanent Fund shows how natural resource wealth can be shared with all citizens. These examples prove that alternatives to pure billionaire predation are possible.

Just as predators play an important role in nature by keeping prey populations healthy and genetically fit, wealthy individuals and corporations can contribute positively to society through investment, innovation, and job creation.

The key is ensuring they do this in a way that strengthens the whole system rather than depleting it. This necessitates high taxes on extreme wealth, requirements to reinvest profits in workers and communities, and new forms of corporate ownership that share gains more broadly.

Looking ahead, our challenge is to move from predation to partnership like America did in the 1930s and Europe did in the 1950s. We must recognize that everyone’s prosperity — including that of the wealthy — depends on having a healthy middle class.

Creating this balance isn’t just morally right; it’s necessary for the economy and our political system to function well. By learning from both nature and history, we can build an economic and political system that works better for everyone, breaking free from the harsh cycles of boom and bust that have defined the past few decades.

The path forward requires both political will and innovative thinking. We must update our understanding of how modern economies work and be willing to experiment with new forms of regulation and wealth sharing.

The alternative — continuing down the path of unchecked billionaire predation — risks destroying the very system that creates wealth in the first place. Just as ecology teaches us that diverse, balanced ecosystems are the most resilient, economics shows us that broadly shared prosperity creates the strongest foundation for sustainable growth and political stability.

Hi Garry, This is the most interesting and insightful article I’ve read in a very long time! Thank you for sharing, Terri

Thanks for the positive feedback, Terri. I try to find subjects I’m interested in, then research and write to understand them. Hopefully others will, too. I try to stay away from politics, so I toned down that aspect in this piece, even if Elon Musk has effectively bought the assistant president position.