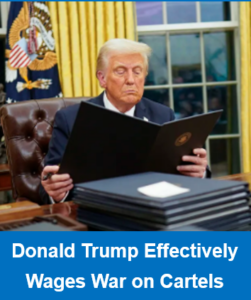

On his first day back in office, January 20, 2025, United States President Donald Trump signed an extraordinarily powerful executive order titled Designating Cartels and Other Organizations as Foreign Terrorists Organizations and Specially Designated Global Terrorists. The document contains terms like “unacceptable national security risk”, “take all appropriate action”, and “ensure the total elimination of these organizations”. With a black pen and a bold signature, Donald Trump has effectively waged war on the cartels.

On his first day back in office, January 20, 2025, United States President Donald Trump signed an extraordinarily powerful executive order titled Designating Cartels and Other Organizations as Foreign Terrorists Organizations and Specially Designated Global Terrorists. The document contains terms like “unacceptable national security risk”, “take all appropriate action”, and “ensure the total elimination of these organizations”. With a black pen and a bold signature, Donald Trump has effectively waged war on the cartels.

Trump’s action is unprecedented. It commands his military, law enforcement, and security agencies to devise a designation plan and begin direct action within fourteen days. By Monday, February 03, 2025, it’s open season on domestic and foreign criminals (now designated as terrorists) like the Sinaloa and Jalisco New Generation Mexican cartels as well as Tren de Aragua (TdA) and Mara Salvatrucha (MS-13) in Central America.

Let’s examine what this document says, look at who the intended targets are, and speculate on what will happen to them. First, though, here’s a synopsis of what a presidential executive order is and the spectacular authority it contains.

Article II of the Constitution of the United States opens with “The executive Power shall be vested in a President of the United States of America.” Using accredited legal resources from Black’s Law Dictionary and the United States Supreme Court database, here’s what this means:

In the context of Article 2 of the U.S. Constitution, which discusses the role of the President, the terms “executive,” “power,” and “vested” have specific meanings:

- Executive: This term refers to the branch of government responsible for enforcing laws and administering public policy. In the United States, the executive branch is headed by the President. The term encompasses the idea of executing or carrying out the laws and directives legislated by the government.

- Power: In this context, “power” refers to the legal authority or capacity to act granted to the President and the executive branch. This includes a wide range of duties and responsibilities such as implementing and enforcing laws, directing national defense and foreign policy, and managing the day-to-day operations of the federal government.

- Vested: “Vested” means conferred, endowed, or established in a specific position or authority. When the Constitution states that the “executive Power shall be vested in a President,” it means that the full authority of the executive branch is formally and securely given to the President.

Therefore, the opening clause of Article 2 establishes that the President holds the full authority to operate the executive branch of the U.S. government. Of utmost importance is the President’s responsibility of keeping the nation and its citizens safe. The cartels, now designated as terrorists, are a “clear and present danger” to Americans which justifies using whatever force is necessary to eliminate the threat.

Executive orders are long-standing tools allowing the president to bypass the glacier-slow process of Congress and act directly on urgent matters. For example, the continual and rising threat of international criminal organizations that do not respond to conventional law enforcement strategies and tactics. These orders are highly enforceable, provided they operate within existing federal statutes and constitutional boundaries.

Once orders are issued, they have the force of law, and federal agencies are compelled to implement and enforce them, However, executive orders can be challenged through the courts. They can also be repealed by the issuing president or reversed by successors.

The true power in executive orders is how they’re worded. No president drafts them alone. They are carefully constructed by presidential advisors and legal experts who ensure the orders are clear, purposeful, and able to strongly withstand scrutiny.

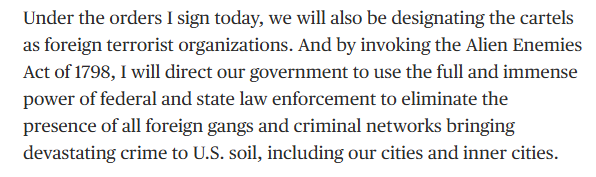

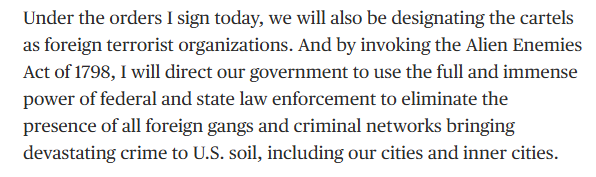

President Trump backs the terrorist designation through existing statutes that guarantee his ability to take immediate action on such a high-profile problem. In the order’s opening, he evokes the Immigration and Nationality Act and the International Emergency Economics Powers Act. Additionally, in his inaugural address when he states his intention to sign the anti-cartel/terrorist order, Trump references the Alien Enemy and Sedition Act of 1798 which exists and is an immense weapon in his arsenal.

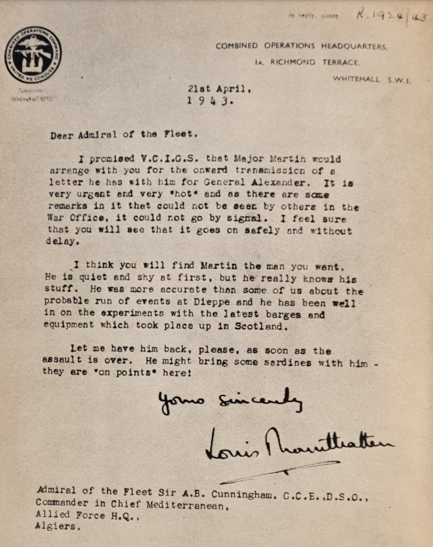

Here’s the entirety of the order to knock out the cartels. It’s important to read this carefully and pay attention to the words and terms stated.

Executive Order—Designating Cartels and Other Organizations as Foreign Terrorist Organizations and Specially Designated Global Terrorists

By the authority vested in me as President by the Constitution and the laws of the United States of America, including the Immigration and Nationality Act (INA), 8 U.S.C. 1101 et seq., the International Emergency Economic Powers Act (IEEPA),50 U.S.C. 1701 et seq. it is hereby ordered:

Section 1. Purpose

This order creates a process by which certain international cartels (the Cartels) and other organizations will be designated as Foreign Terrorist Organizations, consistent with section 219 of the INA (8 U.S.C. 1189), or Specially Designated Global Terrorists, consistent with IEEPA (50 U.S.C. 1702) and Executive Order 13224 of September 23, 2001 (Blocking Property and Prohibiting Transactions With Persons Who Commit, Threaten to Commit, or Support Terrorism), as amended.

(a) International cartels constitute a national-security threat beyond that posed by traditional organized crime, with activities encompassing:

(i) convergence between themselves and a range of extra-hemispheric actors, from designated foreign-terror organizations to antagonistic foreign governments;

(ii) complex adaptive systems, characteristic of entities engaged in insurgency and asymmetric warfare; and

(iii) infiltration into foreign governments across the Western Hemisphere.

The Cartels have engaged in a campaign of violence and terror throughout the Western Hemisphere that has not only destabilized countries with significant importance for our national interests but also flooded the United States with deadly drugs, violent criminals, and vicious gangs.

The Cartels functionally control, through a campaign of assassination, terror, rape, and brute force nearly all illegal traffic across the southern border of the United States. In certain portions of Mexico, they function as quasi-governmental entities, controlling nearly all aspects of society.

The Cartels’ activities threaten the safety of the American people, the security of the United States, and the stability of the international order in the Western Hemisphere. Their activities, proximity to, and incursions into the physical territory of the United States pose an unacceptable national security risk to the United States.

(b) Other transnational organizations, such as Tren de Aragua (TdA) and La Mara Salvatrucha (MS-13) pose similar threats to the United States. Their campaigns of violence and terror in the United States and internationally are extraordinarily violent, vicious, and similarly threaten the stability of the international order in the Western Hemisphere.

(c) The Cartels and other transnational organizations, such as TdA and MS-13, operate both within and outside the United States. They present an unusual and extraordinary threat to the national security, foreign policy, and economy of the United States. I hereby declare a national emergency, under IEEPA, to deal with those threats.

Sec. 2. Policy

It is the policy of the United States to ensure the total elimination of these organizations’ presence in the United States and their ability to threaten the territory, safety, and security of the United States through their extraterritorial command-and-control structures, thereby protecting the American people and the territorial integrity of the United States.

Sec. 3. Implementation

(a) Within 14 days of the date of this order, the Secretary of State shall take all appropriate action, in consultation with the Secretary of the Treasury, the Attorney General, the Secretary of Homeland Security, and the Director of National Intelligence, to make a recommendation regarding the designation of any cartel or other organization described in section 1 of this order as a Foreign Terrorist Organization consistent with 8 U.S.C. 1189 and/or a Specially Designated Global Terrorist consistent with 50 U.S.C. 1702 and Executive Order 13224.

(b) Within 14 days of the date of this order, the Attorney General and the Secretary of Homeland Security shall take all appropriate action, in consultation with the Secretary of State, to make operational preparations regarding the implementation of any decision I make to invoke the Alien Enemies Act, 50 U.S.C. 21 et seq., in relation to the existence of any qualifying invasion or predatory incursion against the territory of the United States by a qualifying actor, and to prepare such facilities as necessary to expedite the removal of those who may be designated under this order.

Sec. 4. General Provisions

(a) Nothing in this order shall be construed to impair or otherwise affect:

(i) the authority granted by law to an executive department or agency, or the head thereof; or

(ii) the functions of the Director of the Office of Management and Budget relating to budgetary, administrative, or legislative proposals.

(b) This order shall be implemented consistent with applicable law and subject to the availability of appropriations.

(c) This order is not intended to, and does not, create any right or benefit, substantive or procedural, enforceable at law or in equity by any party against the United States, its departments, agencies, or entities, its officers, employees, or agents, or any other person.

DONALD J. TRUMP

The White House,

January 20, 2025

In closely reviewing this document, these phrases stand out:

- Certain international cartels (the Cartels)

- Other organizations

- Designated as Foreign Terrorist Organizations

- National security threat

- Beyond that posed by traditional organized crime

- Range of extra-hemispheric actors

- Antagonistic foreign governments

- Complex adaptive systems

- Entities engaged in insurgency

- Asymmetric warfare

- Unacceptable national security threat

- Stability of international order

- Within and outside the United States

- Ensure total elimination of these organizations

- Extraterritorial command-and-control structures

- Within 14 days

- Designate

- Take all appropriate action

Them’s fightin’ words. No matter what one thinks of Donald Trump as a person, no one can deny that he’s a man of action. Trump has effectively waged war on the cartels. Let’s examine who these organizations are that are gonna get it and then investigate what weapons Trump will use to win a war where he’s determined to triumph.

Back to our legal resources, a criminal cartel refers to an organization formed by individuals or businesses who engage in illegal activities, particularly those that involve economic crimes such as price fixing, market division, bid rigging, or other antitrust violations. These activities are typically secret and aim to control or manipulate markets, restrict competition, inflate prices, or maintain high profit margins through illicit means.

Specifically, a drug trafficking cartel is a criminal organization involved in the large-scale production, transportation, and distribution of illegal drugs. These cartels operate with a hierarchical structure that often includes leaders, middlemen, enforcers, and distributors. Their operations span multiple countries and regions, making them complex and extensive networks that are difficult for law enforcement to dismantle.

Drug cartels are known for their violent methods to control territories, eliminate competition, and influence government and law enforcement entities through corruption and intimidation. The immense profits derived from drug trafficking allow these cartels to wield significant power and resources, which they often use to perpetuate their criminal activities and evade justice.

Under United States law, a foreign terrorist organization (FTO) is defined as a foreign organization that:

- Engages in terrorist activity or terrorism, which threatens the security of U.S. nationals or the national security (national defense, foreign relations, or the economic interests) of the United States.

- Is designated by the Secretary of State, in accordance with section 219 of the Immigration and Nationality Act (INA).

Terrorist activity includes actions like hijackings, kidnappings, assassinations, the use of explosives, firearms, or other weapons intended to cause death or serious bodily injury, and violent attacks on internationally protected persons.

The designation of an organization as an FTO has significant legal implications. It becomes illegal for persons in the United States or subject to U.S. jurisdiction to knowingly provide “material support or resources” to a designated FTO. U.S. financial institutions are also required to freeze assets linked to FTOs. Additionally, members and representatives of designated FTOs are barred from receiving visas and may be excluded from entering the country.

These organizations contribute to a wide range of societal problems, including public health crises, crime, violence, and corruption, profoundly impacting the stability and security of the regions in which they operate.

By his executive order signed on January 20, 2025, Donald Trump has linked the drug cartels to foreign terrorists. He has way more authority and resources to attack his enemies when they are labeled as terrorists, foreign terrorists, and that will be done by February 3rd. These are the primary groups in his crosshairs:

Sinaloa Cartel: The Sinaloa Cartel, based in Mexico, is one of the most powerful and notorious drug trafficking organizations globally. Originally led by Joaquín “El Chapo” Guzmán, the cartel has played a major role in the global narcotics trade, especially in the production and distribution of Mexican heroin, methamphetamine, marijuana, and cocaine. Known for its sophisticated smuggling operations and violent enforcement tactics, the cartel has significantly influenced drug trafficking dynamics, contributing to widespread violence and corruption within Mexico and impacting drug policy and law enforcement efforts in the United States and other countries.

Jalisco New Generation Cartel (CJNG): The Jalisco New Generation Cartel, often abbreviated as CJNG, emerged as a powerful drug trafficking entity in Mexico around 2010. Known for its aggressive expansion tactics and direct confrontations with both rival cartels and state forces, CJNG rapidly grew into one of the most formidable and violent cartels in Mexico. Under the leadership of Nemesio Oseguera Cervantes, also known as “El Mencho,” the cartel operates with extreme brutality and engages in a wide range of criminal activities, including drug trafficking, extortion, and murder, significantly affecting Mexico’s security landscape.

Tren de Aragua: Tren de Aragua is a criminal gang originating from the Aragua state in Venezuela, initially formed within the Tocorón prison in 1986. It has since evolved into one of the most feared and violent criminal organizations in Venezuela, extending its operations to other Latin American countries. Engaged in drug trafficking, kidnapping, extortion, and human trafficking, Tren de Aragua’s activities have not only destabilized regions within Venezuela but also posed significant challenges to law enforcement across borders, reflecting the broader issues of prison-based gang control and corruption in Venezuela.

Mara Salvatrucha (MS-13): Mara Salvatrucha, commonly known as MS-13, is a transnational gang that originated in Los Angeles in the 1980s, founded by Salvadoran immigrants in the city’s Pico-Union neighborhood. The gang later expanded into Central America when its members were deported from the U.S., significantly impacting the region’s stability. MS-13 is known for its brutal violence and its involvement in various criminal activities, including murder, human trafficking, drug trafficking, and extortion. The gang’s extensive network and ruthless tactics have made it a major focus of law enforcement agencies in the United States and Central America, symbolizing the complex interplay between migration, deportation, and transnational crime.

Other honorable mentions go to these mostly defunct players from a former era:

- Los Zetas Cartel

- Gulf Cartel

- Tijuana Cartel

- Beltran-Leyva Organization

So those are the thugs placed on notice. That leads to questioning how Donald Trump and his American resources will carry out the plan, much of which will occur on foreign soil and within other sovereign territory. These are the strategic and tactical options:

- International Diplomacy

- Legal Measures

- Sanctions and Asset Freezes

- Prosecution under FTO laws

- Increased Surveillance and Intelligence

- Interagency Cooperation

- Use of Advanced Technology

- Deployment of Special Forces

The most likely scenario will be a combination of the first seven. Option 8, actively placing American soldiers on foreign ground has extreme risks, both from international relations and personnel safety. That will likely be a last resort and only in highly-planned, attack and retract situations.

More likely is the Trump administration will take a page from the recent Israeli playbook. They’ll identify the leaders’ locations and kill them with guided munitions. Then they’ll take away the money and arms.

But never underestimate the cajónes on Donald Trump. While signing the Designation Order, a reporter asked if he would deploy American soldiers on the ground in Mexico. Trump smiled and said, “You never know. Stranger things have happened.”

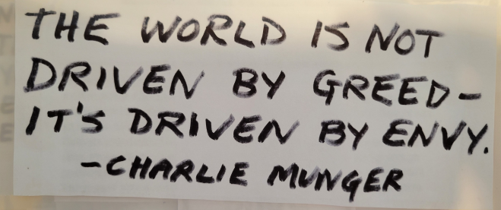

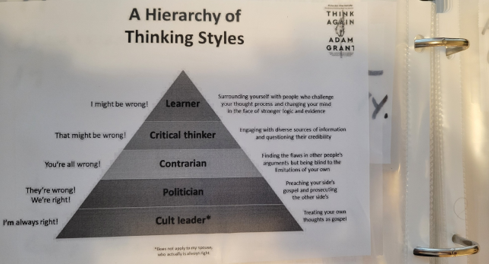

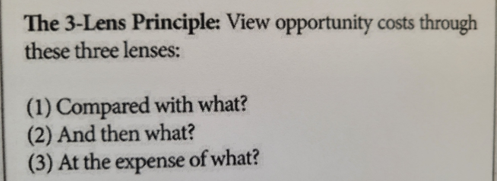

Creative writing stands upon two concrete, foundational pillars. Ideas and information. As a metaphor, information is cement and ideas are the mixer. You can’t build a story or construct an article without either. And there’s a long-used tool that lets you blend ideas and information within one toolbox. The box contains scraps of wisdom—keeping a commonplace book.

Creative writing stands upon two concrete, foundational pillars. Ideas and information. As a metaphor, information is cement and ideas are the mixer. You can’t build a story or construct an article without either. And there’s a long-used tool that lets you blend ideas and information within one toolbox. The box contains scraps of wisdom—keeping a commonplace book.